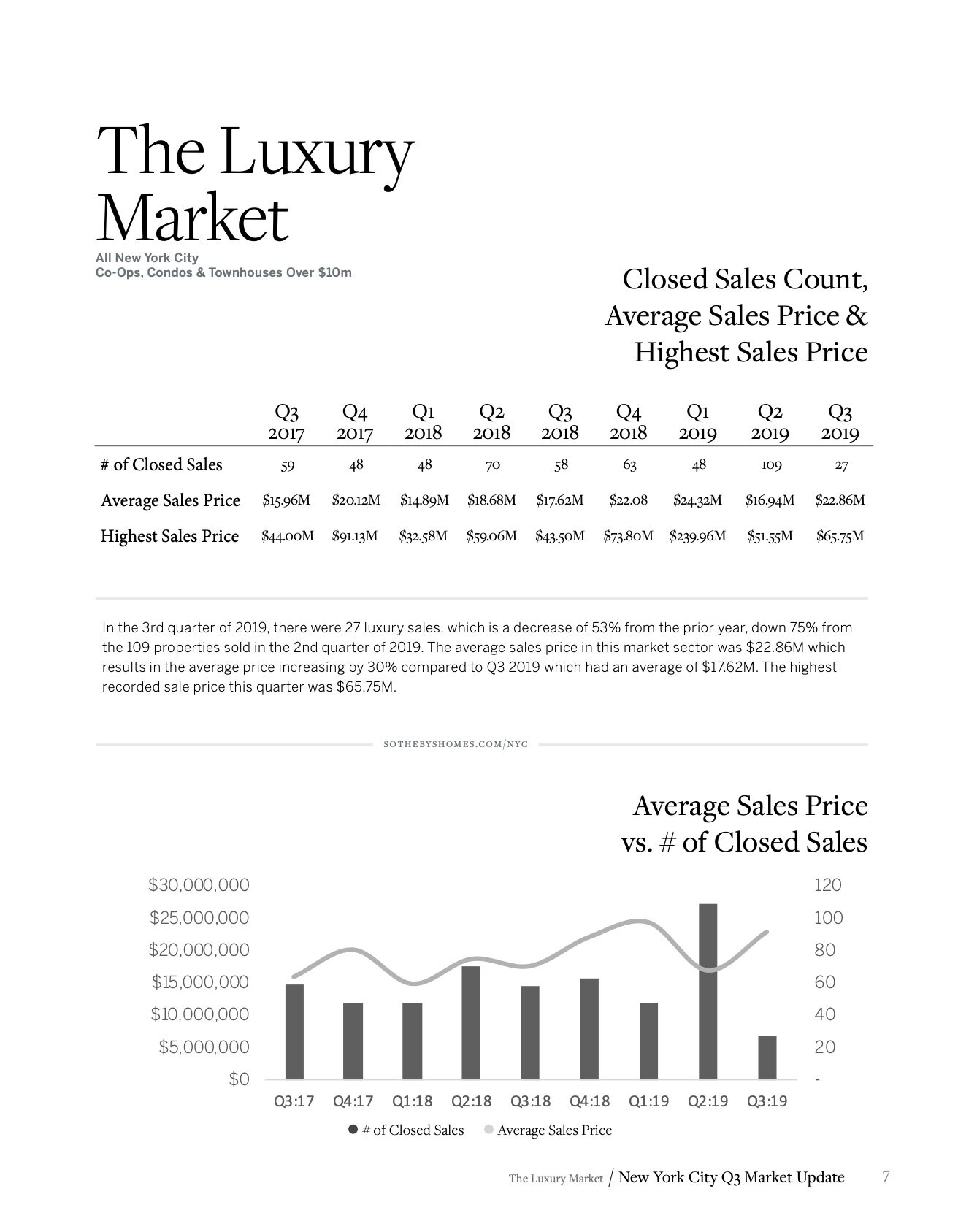

Market Reports

This website is not the official website of Sotheby’s International Realty, Inc. Sotheby’s International Realty, Inc. does not make any representation or warranty regarding any information, including without limitation its accuracy or completeness, contained on this website.